The Inflation Reduction Act (IRA) of 2022 signaled a push to incentivize and reward companies for climate and green energy-related projects. The IRA funds over a total of $369 billion for introduced programs, making it the most ambitious climate and green energy incentives program to date. A new production tax credit that was introduced with the IRA is the Section 45L Energy Efficient Home Credit.

45L Tax Credit History

Originally introduced by the Energy Policy Act of 2005, and taking effect January 1, 2006, the 45L Tax Credit was created to incentivize the development of energy-efficient residential single-family and multi-family housing. Prior to January 1, 2023 (during eligible claim periods) the tax credit is a potential $2,000 per unit or per home.

In 2022 with the passing of the Inflation Reduction Act, the tax credit was increased to a potential $5,000 per unit or per home that meets the Department of Energy’s Zero Energy Ready Home certification (NOTE: This only applies to projects placed in service after January 1, 2023). Currently, the 45L Tax Credit can be claimed through Calendar Year 2032.

Who is eligible for 45L Tax Credits?

- Builders of single-family homes and multi-family housing communities

- Eligible contractors who have equity during the construction process

- Developers of residential real estate (both single-family and multi-family)

Eligible buildings

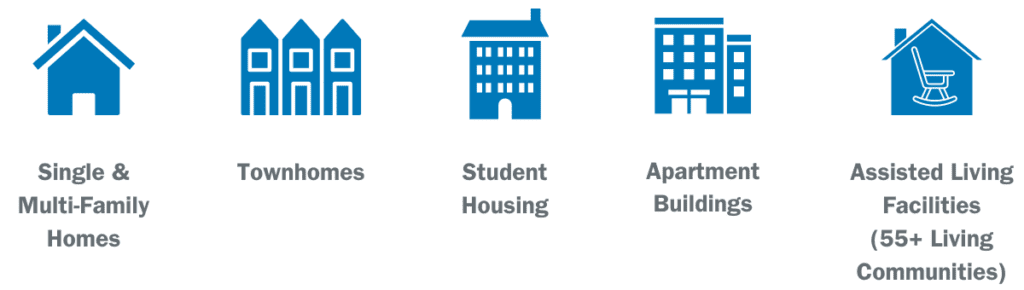

The types of buildings eligible for a 45L tax credit include:

These are not complete lists of eligible buildings. Please contact us for a free consultation with one of our experts to answer any questions and identify all opportunities.

45L Eligible Home Features

Homes that qualify for 45L tax credits are highly energy efficient and have several features built in that save on energy expenditure. Features commonly seen in 45L eligible homes include:

- Optimal Insulation – keeps living areas cool in the summer and warm in the winter, is professionally installed and inspected by a 3rd party.

- Fresh Air Ventilation – adds to improved indoor air quality, completely removes & replaces stale air three times daily.

- HVAC – highly efficient heating and cooling tech, also moderates indoor moisture for better air quality.

- Water Heater – highly efficient water heater systems and plumbing systems that deliver hot water quickly and with low energy usage.

- Safe Building Materials – building components that are low emissions that meet industry standards for VOC content.

- Energy Star Appliances – low energy-use appliances like ovens, refrigerators, microwaves and more.

- High-Performance Windows – all windows meet strict requirements for insulation and energy efficiency.

- Solar Readiness – pathways installed to run wiring to future or additional solar panels for easy addition.

- EV Charging – electrical infrastructure for electric vehicle charging stations has been installed on the premises.

- Heat Pump compatibility – utility hookups and energy system is ready for installation of future heat pump technologies to heat water and living areas.

- LED Lighting – Lighting systems make use of efficient LED light bulbs instead of incandescent.

NOTE: These features alone do not make a home eligible for the 45L tax credit. All 45L-eligible homes must go through rigorous Energy Star and ZERH certifications to qualify for tax credits.

45L Tax Credit Qualifications

Entities that are eligible to claim a 45L tax credit must fulfill these basic requirements:

- Homeowners and property taxpayers who’ve newly built or reconstructed homes are eligible to claim the 45L tax credit

- Home must be built in the US

- Home is certified through Energy Star and/or ZERH programs

Energy Star Certifications

All homes built or reconstructed to be eligible for 45L tax credits must meet and earn Energy Star qualifications. Aspects of these qualifications include:

- Thermal Enclosure Systems – air sealing that delivers 10% on energy efficiency, high-quality insulation, and high-performance windows

- Heating & Cooling – efficient HVAC systems properly installed that deliver improved indoor air quality

- Indoor Air Quality – consistent delivery of fresh air into the home; exhaust fans from kitchens and bathrooms; MERV 6+ air filtration systems; power or direct vented furnaces, water heaters and more; water & moisture management systems; air sealed walls, ceilings and floors

- Advanced Lighting & Appliances – incorporates long-lasting energy efficient Energy Star-certified lighting systems and large appliances

- Third Party Inspections & Tests – rigorous testing by an independent Energy Rating Company certified by EPA recognized certification organizations (Home Certification Organization – HCO, Multifamily Review Organization – MRO, or Quality Assurance Provider – QAP)

Energy Star Certification in 4 steps

- Home builder or multifamily developer becomes an Energy Star partner, committing to meet all Energy Star efficiency requirements.

- The builder or developer gets architectural plans reviewed & approved by an Energy Rating Company (ERC) for energy efficiency and energy saving techniques.

- The home is constructed and inspected along the way to meet Energy Star requirements for efficiency, comfort, durability, and quality.

- The ERC determines Energy Star requirements have been achieved, and a Home Certification Organization undertakes an additional quality assurance assessment before the Energy Star label is applied to the home’s circuit breaker.

DoE Zero Energy Ready Home (ZERH) Program Certification

In order for a home to be certified as a ZERH home by the U.S. Department of Energy, it must first fulfill the basic requirements for Energy Star Certification. Then the building must comply with additional specific requirements outlined for building envelope standards, duct systems, water efficiency, indoor air quality, readiness for renewable energy tie-ins and high-efficiency lighting and appliances.

How To Claim 45L

The applicant must complete IRS Form 8908 and have certification that the dwelling meets ZERH and/or Energy Star program requirements and should have necessary paperwork records to show that additional requirements, such as meeting prevailing wage requirements, have been satisfied.

Consult with a tax professional like the team at Ayming to ensure you have all the necessary documentation and will get the benefits you’re entitled to.

45L Tax Credit Claiming periods

The Section 45L Energy Efficient Home Credit can be retroactively claimed for up to 3 previous open tax years, and ultimately requires Form 8908 to be claimed on an original tax return or Form 3800 for an amended tax year return. Our Ayming team will work hand in hand with your team to ensure your credits are properly claimed.