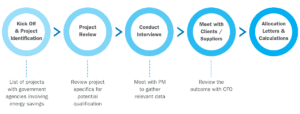

The Inflation Reduction Act (IRA) of 2022 signaled a push to incentivize and reward companies for climate and green energy-related projects. The IRA funds over a total of $369 billion for introduced programs, making it the most ambitious climate and green energy incentives program to date. A new production tax credit that was introduced with the IRA, the Section 45X Advanced Manufacturing Tax Credit, is a credit for manufacturers of eligible components produced by a taxpayer within the United States and sold to an unrelated party.

45X Tax Credit offers substantial benefits

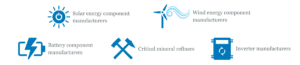

Clean energy component manufacturing that qualify for the 45X include wind, solar, and battery projects, such as PV cells, PV wafers, solar modules, blades, nacelles, inverters, and battery cells and modules, among many others that are made in the United States and sold to a 3rd unrelated party, starting in 2023.

These are not complete lists of eligible projects or industries. To identify all opportunities, you may schedule a free consultation with one of our experts.

Start claiming now!

Section 45X is now available to claim on your current tax return for 2023. If you are a non-taxable entity, Ayming USA can calculate your potential credit and help you sell the credit fully or partially to a 3rd party taxpayer.