Our experts provide their thoughts and opinions on the trends and developments impacting our clients.

Our latest thinking

The R&D Tax Credit and the Role of CPA Firms

How companies can maximize returns by understanding the role of their CPAs and R&D Tax Credit specialists Taxpayers often hire…

More

Lauren Highsmith highlights how R&D Tax Credits can assist in direct cash back for your business Cash flow is important…

Cash Flow Upside from Claiming R&D Tax Credits

Innovation and Tax Credit Qualifications Companies across America exist in an increasingly competitive marketplace, which drives the need for innovation…

Dispelling the Myth of Who Qualifies for R&D Tax Credits

Ayming Institute’s latest book is out! Following its first book, The Balanced Business, exploring the good practices to thrive and…

5 European Women – Shaping European Business Performance, Ayming Institute’s Latest Release

Ayming is expanding quickly in the U.S. and as the market offers new opportunities, we are growing our teams all…

Ayming U.S Job Dating in Houston a Success

Ayming Institute is the reflection and innovation laboratory of the Ayming Group. It brings together all the intellectual content developed…

What is Ayming Institute?

It’s about time architecture and engineering firms took a break – a tax break that is. Despite the broad range…

R&D Tax Credits Can Help Architecture and Engineering Firms Develop A Blueprint for Growth

R&D Tax Credits Should Be Part of Biotech’s DNA

Due to the need for constant product and process developments, the cost of R&D for the biotech industry is…

More

Why are software companies investing their own capital into R&D initiatives, but not claiming, or drastically under claiming, the established…

From Beta to Data: Why Software Companies Should Claim the R&D Tax Credit Throughout the Development Lifecycle

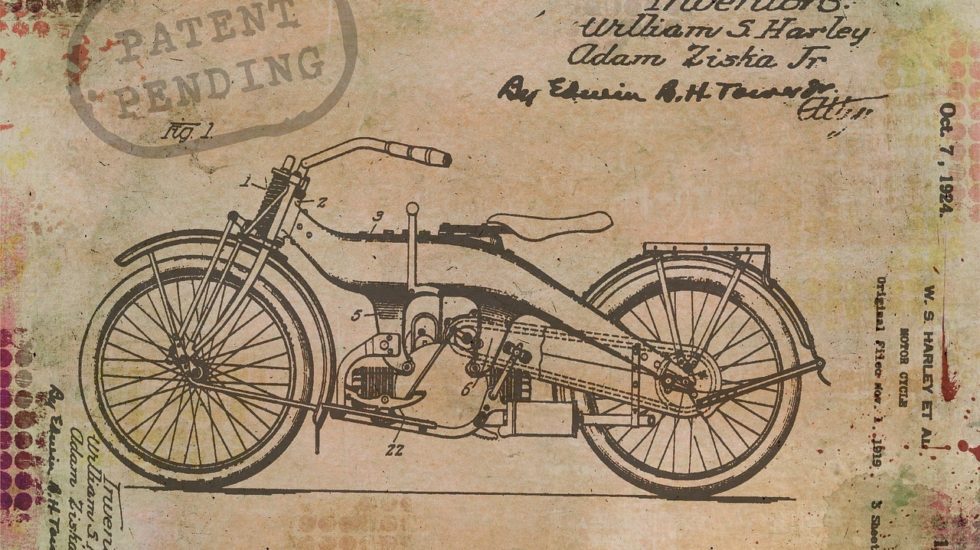

If a company’s patent application is accepted, the IRS considers that the project meets the 3 key qualifying criteria for…

All Companies Holding Patents Are Eligible for R&D Tax Credits

North America spends more on MRO than any other region and is forecasted to do so throughout the next ten…

Sky High Costs: Not Optimizing Aerospace MRO Expenditures Can Make Profits Crash

R&D tax credits can help aviation maintenance take flight. While many companies are already performing eligible activities, identifying and documenting…

R&D Tax Credits: What the Aviation Maintenance Industry Should Know

While many in the plant growing industry turn to financial institutions or private investors as potential sources of funding, there…

Growing Concern: Plant Industry May Not Be Claiming R&D Tax Credits, But It Should

What is the R&D Tax Credit ? The R&D Tax Credit helps companies remain competitive by allowing a reduction of…

Latest Changes to R&D Tax Credits Eliminate the AMT