Many factors contribute to the calculation of property tax. Any change in the use of the property, its sale price, demolition, and/or construction will affect its value and the required payable taxes.

Understanding Property Tax

A property tax included in the rental fee represents a significant expense for any business manager and requires a second opinion. Municipal assessments are based on averages using comparative data. This practice can lead to a property tax amount higher than the actual values. Challenging the value of a property is complex and requires specific know-how at each stage of the process. To complicate matters, the process to contest property values can be complex and requires specialized skill sets at different points in the process. You may have found yourself faced with one or more of the following questions:

How Ayming Can Help

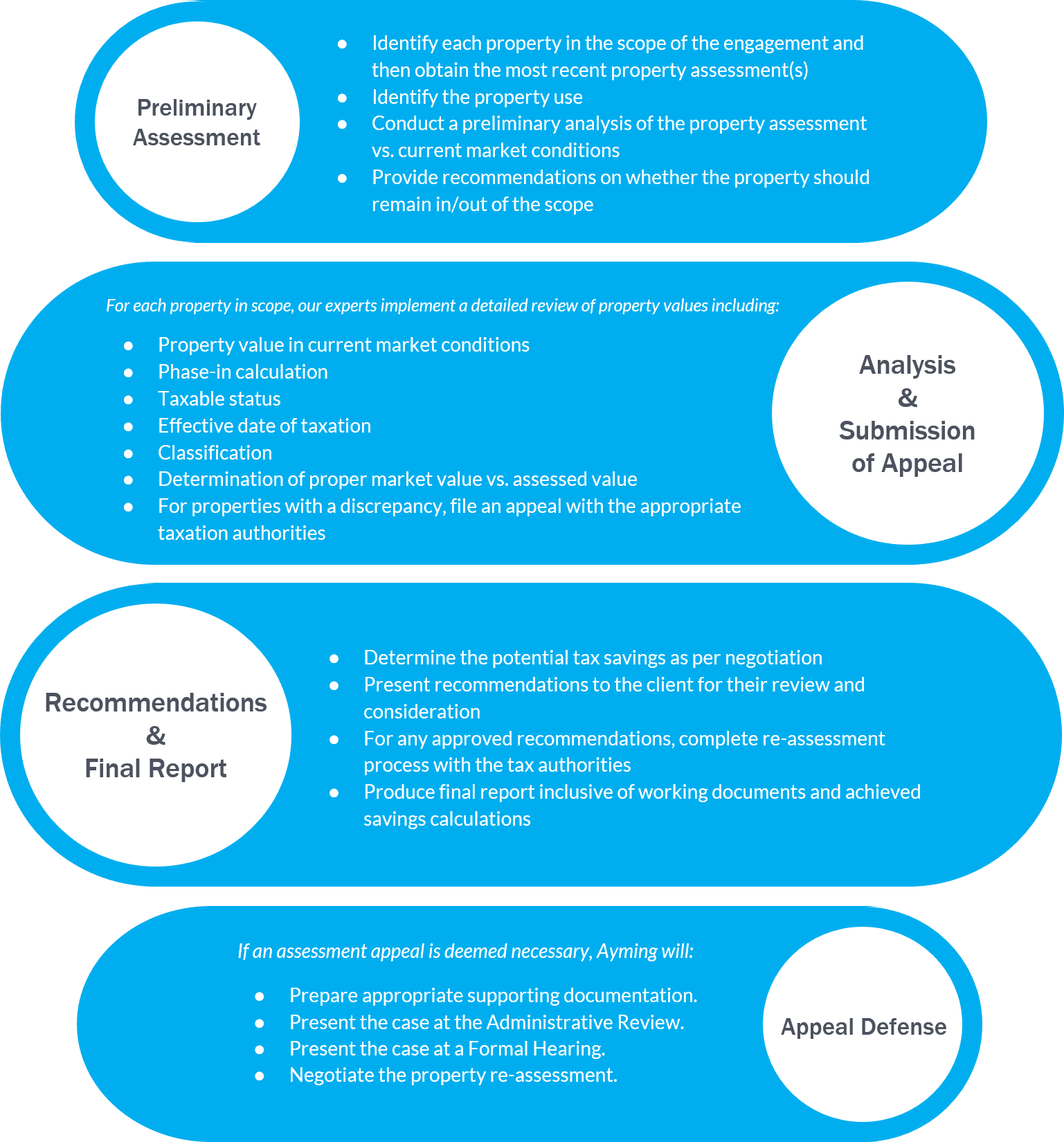

We deploy a team of specialists, including an account manager, who will manage the entire process and minimize the impact of the process on your organization. While conducting an independent appraisal of your property and its’ use, we also have access to a team of appraisers, engineers, and lawyers to manage your re-evaluation at every step of the process.

Ayming has completed over 7,000 property tax assessments and can negotiate a settlement to reduce the amount of property tax payable on your property. Using proven tools and industry-based comparative values, Ayming’s specialists have generated significant savings for their clients.

Our comprehensive evaluation and reporting ensures that our clients are fully aware of their assessment position and provides recommendations to minimize liabilities and errors going forward, by executing on the following: